In an effort to support encourage alternative Electrical power https://shp-constructions.com and Strength conservation, the federal authorities is supplying some tax credits to individuals that get certain products and solutions like insulated windows, energy-effective heat pumps and hybrid cars and trucks.

SHP CONSTRUCTIONS

8 Boulevard des Dames, 13002 Marseille

06 26 65 25 42

https://shp-constructions.com/

In August of 2005 the federal authorities handed the Electrical power Coverage Act, and also the ensuing tax credits went into outcome January one of 2006. Not simply are Electrical power-productive solutions rewarded, but specified creating tactics and supplies are as well.

And that means you save cash on Electricity expenditures and spend a lot less to Uncle Sam way too. Looks like a acquire-gain.

“By cutting down In general Vitality demand a person household or business enterprise at a time,” claimed U.S. Power Secretary Samuel Bodman, “we also are growing The usa’s Strength safety.” The program has the extra reward of currently being environmentally aware.

So how exactly does This system get the job done? It offers tax credits on your federal return. Say you got a whole new hybrid car or experienced your Home windows replaced with insulated types. When April fifteen rolls around, you note the acquisition in your taxes, go ahead and take credit rating and it minimizes the quantity of tax you pay.

Take into account that tax credits are different from tax deductions. A tax deduction is subtracted from the earnings before your tax is calculated. A tax credit is whacked off the tax you have been calculated to pay.

Credits ordinarily account for far better financial savings than deductions. Tax credits help you spend much less taxes than the person With all the same amount of taxable money who did not purchase the motor vehicle.

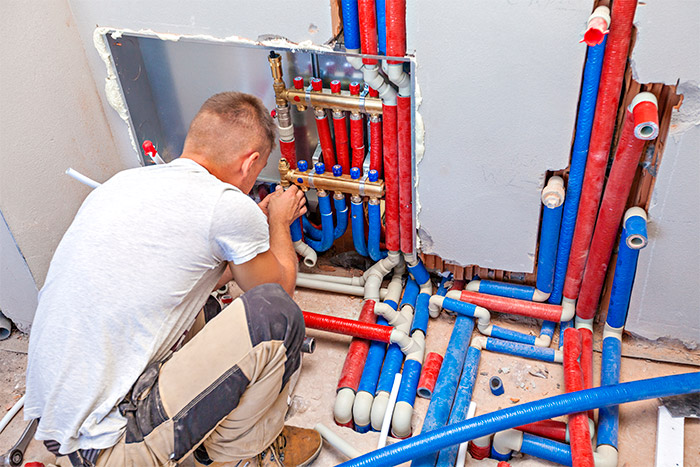

Tax credits can also be accessible for Vitality-productive dwelling advancements like setting up insulation, certain varieties of Home windows and roofing, and solar Strength devices. Of course, since it’s a govt system they’re numerous procedures and restrictions. For a more detailed checklist, pay a visit to This system’s Site at www.ase.org/taxcredits.

If you want even more details, specifics for saving dollars on taxes is offered at www.energytaxincentives.com.

Currently, these incentives are only available with the yrs 2006 and 2007 Except if Congress extends them. Compose to the Congressman these days and inform her or him to vote to increase the act after which start off Making the most of it!